Accrued revenue definition

/What is Accrued Revenue?

Accrued revenue is a sale that has been recognized by the seller, but which has not yet been billed to the customer. This concept is used in businesses where revenue recognition would otherwise be unreasonably delayed. Accrued revenue is quite common in the services industries, since billings may be delayed for several months, until the end of a project or on designated milestone billing dates. Accrued revenue is much less common in manufacturing businesses, since invoices are usually issued as soon as products are shipped.

The concept of accrued revenue is needed to properly match revenues with expenses. The absence of accrued revenue would tend to show excessively low initial revenue levels and low profits for a business, which does not properly indicate the true value of the organization. Also, not using accrued revenue tends to result in much lumpier revenue and profit recognition, since revenues would only be recorded at the longer intervals when invoices are issued. Conversely, recording accrued revenue tends to smooth out reported revenue and profit levels on a month-by-month basis.

Related AccountingTools Courses

Accounting for Accrued Revenue

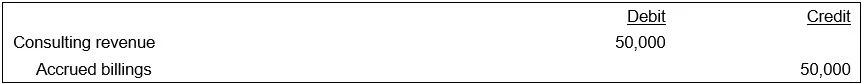

In order to record accrued revenue, you should create a journal entry that debits the accrued billings account (an asset) and credits a revenue account. This results in revenue being recognized in the current period. The entry is reversed when a billing is actually sent to the customer, so that the revenue stated on the billing is offset by the negative revenue figure in the reversing entry. The net effect is that revenue is only recognized in the current period. If there is a difference between the accrued revenue amount and the amount eventually billed, then this difference will impact revenue in the period in which the billing is issued.

If a customer were to submit a payment before a billing was issued to it (perhaps as part of a standardized, periodic payment arrangement), then the appropriate accounting would be to debit the cash account and credit the accrued billings account. Doing so reduces the balance in the accrued billings account.

Accrued revenue is not recorded in cash basis accounting, since revenue under that method is only recorded when cash is received from customers.

Fraudulent Use of Accrued Revenue

The accrued revenue concept has been used to fraudulently increase the revenues of a business with a journal entry. These entries are usually instigated by senior management, which wants to artificially boost sales and profits in an effort to convince investors to bid up the share price of company stock. They can sometimes hide these entries by later declaring a large reserve for expected losses, and writing off the accrued revenue at that time. Otherwise, they must provide the firm’s auditors with documentation for the accrued revenue, which usually uncovers the scam.

Example of Accrued Revenue

ABC International has a consulting project with a large client, under which the consulting agreement clearly delineates two milestones, after each of which the client owes $50,000 to ABC. Since the agreement only allows for billing at the end of the project for $100,000, ABC must create the following journal entry to record reaching the first milestone:

At the end of the next month, ABC completes the second milestone and bills the client for $100,000. It records the following entry to reverse the initial accrual, and then records the second entry to record the $100,000 invoice:

Presentation of Accrued Revenue

The debit balance in the accrued billings account appears in the balance sheet, where it is stated as a current asset. The monthly change in the accrued revenue account appears in the income statement, within the revenue line item at the top of the statement. It is rarely reported separately from billed revenue on the income statement; this is because the amount is usually relatively small in comparison to total sales, and because this account reveals nothing about the nature of the underlying revenue (such as goods or services).

FAQs

How does accrued revenue differ from deferred revenue?

Accrued revenue arises when a company has delivered goods or services but has not yet billed or received payment, so revenue is recognized before cash collection. Deferred revenue occurs when cash is received before goods or services are delivered, creating a liability until the revenue is earned and recognized.

Terms Similar to Accrued Revenue

Accrued revenue is also known as accrued sales.