Deferred revenue definition

/What is Deferred Revenue?

Deferred revenue is a payment from a customer for goods or services that have not yet been provided by the seller. The seller records this payment as a liability, because it has not yet been earned. Once the goods or services related to the customer payment are delivered to the customer, the seller can eliminate the liability and instead record revenue. Deferred revenue is common among software and insurance providers, who require up-front payments in exchange for service periods that may last for many months.

Recognition of Deferred Revenue

As the recipient earns revenue over time, it reduces the balance in the deferred revenue account (with a debit) and increases the balance in the revenue account (with a credit). Depending on the contract terms, the selling entity may not be allowed to recognize revenue until all goods have been delivered and/or services completed; this can skew the reported performance of a business to show early losses, followed by profits in later periods.

The deferred revenue account is normally classified as a current liability on the balance sheet. It can be classified as a long-term liability if performance is not expected within the next 12 months.

Related AccountingTools Courses

Examples of Deferred Revenue

Businesses that provide subscription-based services routinely have to record deferred revenue. For example, a gym that requires an up-front annual fee must defer the amounts received and recognize them over the course of the year, as services are provided. Or, a monthly magazine charges an annual up-front subscription and then provides a dozen magazines over the following 12-month period. As yet another example, a landlord requires a rent payment by the end of the month preceding the rental usage period, and so must defer recognition of the payment until the following month.

Accounting for Deferred Revenue

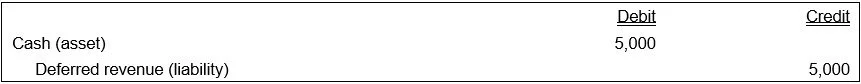

For example, Alpha Corporation hires Northern Plowing to plow its parking lot, and pays $5,000 in advance, so that Northern will give the company first plowing priority throughout the winter months. At the time of payment, Northern has not yet earned the revenue, so it records all $5,000 in a deferred revenue account, using this deferred revenue journal entry:

Northern expects to be plowing for Alpha for a period of five months, so it elects to recognize $1,000 of the deferred revenue per month in each of the five months. For example, in the first of the five months, Northern records the following entry:

Terms Similar to Deferred Revenue

Deferred revenue is also known as prepaid revenue or unearned revenue.