Suspense account definition

/What is a Suspense Account?

A suspense account is an account used to temporarily store transactions for which there is uncertainty about where they should be recorded. Once the accounting staff investigates and clarifies the purpose of this type of transaction, it shifts the transaction out of the suspense account and into the correct account(s). An entry into a suspense account may be a debit or a credit.

It is useful to have a suspense account, rather than not recording transactions at all until there is sufficient information available to create an entry to the correct account(s). Otherwise, larger unreported transactions may not be recorded by the end of a reporting period, resulting in inaccurate financial results.

Related AccountingTools Courses

Example of a Suspense Account

A customer sends in a payment for $1,000 but does not specify which open invoices it intends to pay. Until the accounting staff can ascertain which invoices to charge, it temporarily parks the $1,000 in the suspense account. In this case, the initial entry to place the funds in the suspense account is:

| Debit | Credit | |

| Cash | $1,000 | |

| Suspense account | $1,000 |

The accounting staff contacts the customer, identifies which invoices are to be paid with the $1,000, and shifts the funds out of the suspense account with this entry:

| Debit | Credit | |

| Suspense account | $1,000 | |

| Accounts receivable | $1,000 |

As another example, a supplier delivers an invoice for $2,500 of services, which is payable in 30 days. The accounting staff is uncertain which department will be charged with the invoice, so the accounting staff records the following initial invoice, while the department managers argue over who is responsible for payment:

| Debit | Credit | |

| Suspense account | $2,500 | |

| Accounts payable | $2,500 |

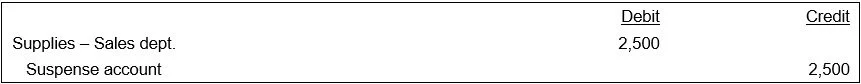

The initial entry records the invoice in the accounts payable system in a timely manner, so that the company can pay it in 30 days. The department managers eventually decide that the office supplies account of the sales department should be charged with the expense, so the accounting staff records the following entry:

Suspense Account Best Practices

There are several best practices that can be applied to the use of a suspense account. They are:

Review it frequently. Regularly review the items in the account, with the objective of shifting transactions into their appropriate accounts as soon as possible. Otherwise, the amounts in the suspense account can grow to quite substantial proportions, and be very difficult to deal with months later, especially if there is minimal documentation of why transactions were initially placed in the account. Accordingly, there should be a daily measurement of the balance in the suspense account, which the controller uses as the trigger for ongoing investigations.

Track repeat offenders. It is useful to track which transactions are repeatedly shunted into the suspense account, so that systems can be enhanced to make it easier to properly identify these items in the future, thereby keeping them out of the account.

Clear out by year-end. Finally, all suspense account items should be researched and eliminated by the end of the fiscal year. Otherwise, a company is issuing financial statements that contain unidentified transactions, and which are therefore incorrect.

Classification of Suspense Accounts

The suspense account is classified as a current asset, since it is most commonly used to store payments related to accounts receivable. It is possible to also have a liability suspense account, to contain accounts payable whose disposition is still being decided. If so, the liability suspense account is classified as a current liability.