Post-closing trial balance definition

/What is a Post-Closing Trial Balance?

A post-closing trial balance is a listing of all balance sheet accounts containing non-zero balances at the end of a reporting period. The post-closing trial balance is used to verify that the total of all debit balances equals the total of all credit balances, which should net to zero. The post-closing trial balance contains no revenue, expense, gain, loss, or summary account balances, since these temporary accounts have already been closed and their balances moved into the retained earnings account as part of the closing process.

Once the accountant has ensured that the total of all debits and credits in the report are the same number, the next step is to set a flag to prevent additional transactions from being recorded in the old accounting period, and begin recording accounting transactions for the next accounting period. This is one of the last steps in the period-end closing process.

If any revenue, expense, gain, loss, or summary account balances appear in the trial balance subsequent to the closing process, it is because they are associated with the next accounting period.

Structure of the Post-Closing Trial Balance

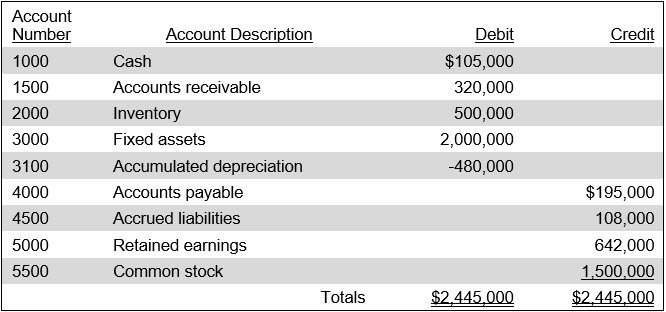

The post-closing trial balance contains columns for the account number, account description, debit balance, and credit balance. It will likely not contain "Post Closing Trial Balance" in the header, since few accounting computer systems use this designation. Instead, it will use the standard "Trial Balance" report header.

Related AccountingTools Courses

Accounting software requires that all journal entries balance before it allows them to be posted to the general ledger, so it is essentially impossible to have an unbalanced trial balance. Thus, the post-closing trial balance is only useful if the accountant is manually preparing accounting information. For this reason, most procedures for closing the books do not include a step for printing and reviewing the post-closing trial balance.

Example of a Post-Closing Trial Balance

Note that there are no temporary accounts listed in the following post-closing trial balance:

ABC Company

Trial Balance

June 30, 20XX

Types of Trial Balances

There are several types of trial balances. The initial one is the unadjusted trial balance. This version contains the ending balances of all accounts in the general ledger, before any adjustments have been made to them with adjusting entries. This is the initial version that an accountant uses when preparing to close the books at the end of the month. It is useful for spotting issues that need to be fixed.

Once all adjusting entries have been recorded, the result is the adjusted trial balance. This one contains entries pertaining to account reconciliation adjustments, depreciation entries, and charges of prepaid expenses to expense. The accountant may prepare a series of adjusted trial balances, making a number of adjusting entries before closing the books for the month.

FAQs

Does the Post-Closing Trial Balance Show Net Income?

The post-closing trial balance does not show net income. Net income has already been closed to retained earnings through closing entries, so revenue and expense accounts have zero balances. Only permanent accounts, such as assets, liabilities, and equity, appear in the post-closing trial balance.

Related Articles

How to Prepare a Trial Balance

The Difference Between an Adjusted and Unadjusted Trial Balance