Types of income statements

/The income statement reports on the revenues, expenses, and profits of an organization. There are several types of income statement formats available, which can be used to present this information in different ways. The key variations on the income statement are noted below.

Classified Income Statement

The classified income statement uses subtotals for the gross margin, operating expenses, and non-operating expenses. This approach is used when there are many line items, thereby aggregating information for easier comprehension. This is also known as a multi-step income statement.

Comparative Income Statement

The comparative income statement presents the results of multiple reporting periods in adjacent columns. This layout is quite useful for evaluating the results of a business over a period of time, and so is heavily used by financial analysts.

Related AccountingTools Courses

Condensed Income Statement

The condensed income statement aggregates the entire income statement into just a few line items, such as one line each for revenues, the cost of goods sold, and operating expenses. This format may be used for reporting to those readers who are only interested in grand totals, such as lenders.

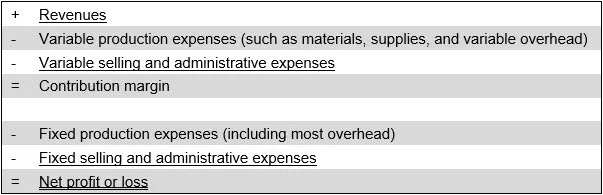

Contribution Margin Income Statement

The contribution margin income statement only includes variable expenses in the cost of goods sold, and pushes all fixed production costs lower down in the report. This makes it easier to discern the contribution margin on product and service sales, and to calculate the break even point of a business. The format of a contribution margin income statement appears below.

Single-Step Income Statement

The single-step income statement includes subtotals only for revenues and for all expenses. This approach is usually reserved for smaller organizations that have few line items in their income statements.

There are two other types of income statements that do not have unique formats. Instead, they present different types of information. They are noted next.

Cash Basis Income Statement

The cash basis income statement only contains revenues for which cash has been received from customers, and expenses for which cash has been paid to suppliers. Its results can vary from those of an income statement prepared under the accrual basis of accounting.

Partial Income Statement

The partial income statement states the results of a partial period. It is most commonly used when a business has just started, and the first reporting period encompasses less than a full month.

Related Articles

How Sales Commissions are Reported in the Income Statement