Other current liabilities definition

/What are Other Current Liabilities?

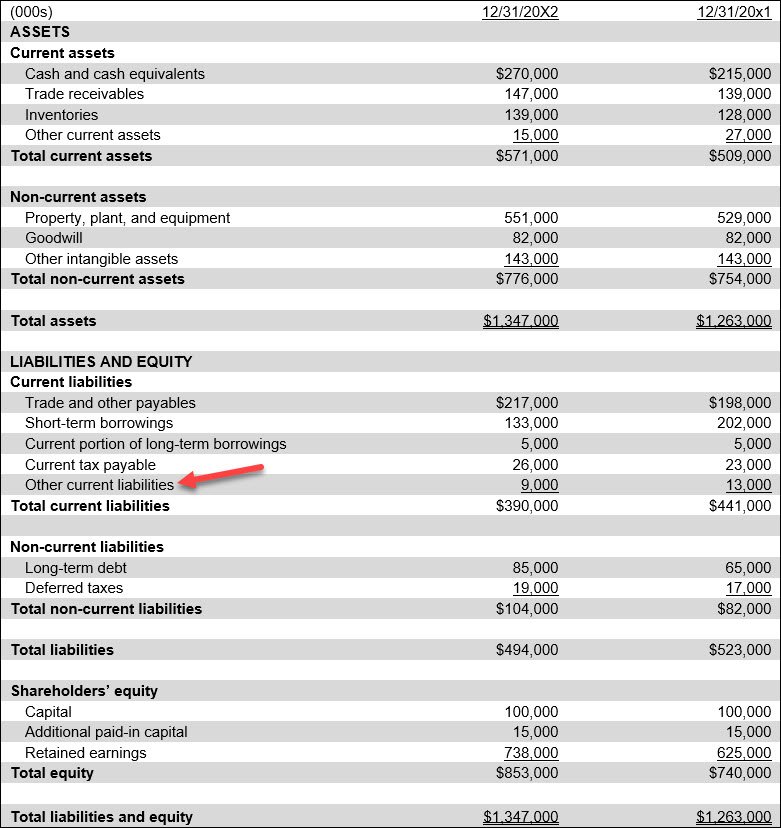

Other current liabilities are the residual liabilities of an organization that are not classified within one of the other current liability accounts. It is a line item in the balance sheet, in which is aggregated several current liability accounts that are too minor to report separately. It is typically the last line item stated within the current liabilities section of the balance sheet. A sample presentation of this line item appears in the following balance sheet exhibit.

The contents of this line item may be explained in more detail in the accompanying footnotes.

Types of Other Current Liabilities

The exact types of liabilities that are presented within the other current liabilities classification will vary by company, depending on the nature and size of the liabilities incurred. Here are some of the more common types of other current liabilities:

Accrued expenses. Accrued expenses are obligations for goods or services that have been received but not yet paid for by the end of the accounting period. Common examples include wages payable, interest payable, and taxes payable, all of which are typically settled within a short time frame.

Customer deposits. Customer deposits represent cash received from customers before goods are delivered or services are performed. These deposits are recorded as a liability because the company still owes a product or service in the future.

Dividends payable. Dividends payable are declared dividends that have been approved by a company's board of directors but have not yet been paid to shareholders. This liability typically exists for a short period between the declaration date and the actual payment date.

Unearned revenue. Unearned revenue is cash received from customers for products or services that have not yet been provided. It is considered a liability until the company fulfills its obligation by delivering the promised goods or services.

Interest payable. Interest payable represents interest expenses that have been incurred but not yet paid on loans or other debt instruments. This liability is recognized to match the expense to the period in which it is incurred.

Related AccountingTools Courses

FAQs

When should an item be reclassified out of other current liabilities?

An item should be reclassified out of other current liabilities when it becomes material or consistently recurring. Separate presentation improves transparency and helps users better understand the nature of the obligation. Any reclassification should be clearly explained in the financial statement disclosures.