Nonprofit Accounting Explained

/Nonprofit organizations are integral to cultural, educational, religious, humanitarian, and other mission-based efforts within society. Unlike for-profit businesses that generate revenue to provide returns to owners or shareholders, nonprofits depend primarily on donations, grants, and similar support to finance their activities. They have no equity holders and cannot distribute profits; any surplus is retained and used to advance their mission. Due to heightened accountability and disclosure expectations, nonprofits apply a specialized reporting framework called fund accounting to track revenues and expenses. Mastery of these principles helps leaders allocate resources wisely, refine fundraising strategies, evaluate programs, and sustain long-term mission effectiveness.

What is Nonprofit Accounting?

Nonprofit accounting is a specialized discipline designed for charitable and mission-driven entities whose objective is stewardship rather than profit generation. Unlike a retail business that records sales revenue without regard to donor intent, a nonprofit must classify incoming resources according to externally imposed restrictions and report on their use with heightened transparency to donors and boards.

Consider two contrasting scenarios. A community foundation awards a $50,000 grant to expand a literacy program. Because the grant agreement specifies instructional materials and tutor stipends, those resources are restricted and must be tracked separately. By contrast, a long-time supporter contributes $5,000 with no stated purpose. Those funds are unrestricted and may be applied to rent, utilities, or administrative support. Fund accounting requires distinct tracking mechanisms so that restricted funds are not commingled with general operating resources.

In the United States, nonprofit reporting follows Financial Accounting Standards Board guidance under GAAP, ensuring consistent, decision-useful financial statements for stakeholders.

Related AccountingTools Courses

Comparing Bookkeeping and Accounting in a Nonprofit

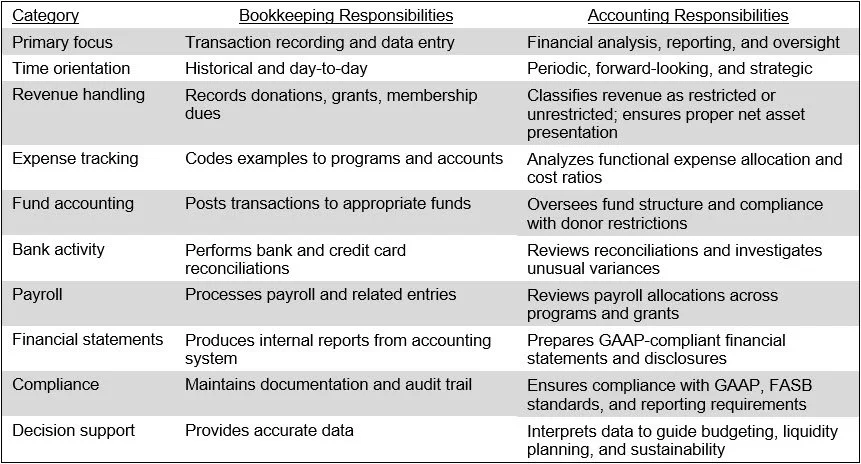

Confusion frequently arises within nonprofits regarding the distinction between bookkeeping and accounting. Board members and executive directors may assume the terms are interchangeable, particularly in smaller organizations where one individual performs both functions. This misunderstanding can lead to unrealistic expectations, weak internal controls, and gaps in financial oversight. Bookkeeping is transactional and compliance-oriented, while accounting is analytical and strategic. In a mission-driven environment governed by fund accounting, the distinction becomes even more important because resources may be restricted, reporting obligations are heightened, and financial statements must comply with GAAP. The key determining factors are as follows:

Bookkeeping in a nonprofit. Bookkeeping focuses on recording daily financial transactions, including donations, grant receipts, payroll, vendor payments, and bank reconciliations. It ensures that restricted and unrestricted funds are coded properly, accounts are balanced, and documentation is retained. The emphasis is on accuracy, timeliness, and compliance with internal procedures.

Accounting in a nonprofit. Accounting involves interpreting financial data, preparing GAAP-compliant financial statements, managing fund classifications, analyzing program costs, supporting audits, and advising leadership on budgeting, liquidity, and financial sustainability. It translates transactional data into actionable insight.

There is a clear role separation between bookkeeping and accounting. When nonprofits understand the difference, they enhance both compliance and strategic stewardship. The key differences are noted in the following table.

Nonprofit Chart of Accounts

A nonprofit’s chart of accounts, when structured using the Unified Chart of Accounts (UCOA), is designed to support fund accounting, donor transparency, functional expense reporting, and Form 990 alignment. The UCOA framework standardizes account groupings so that internal financial statements, grant reports, and external filings can be generated consistently. The structure typically incorporates both natural classifications, such as salaries or rent, and functional classifications, such as program, management and general, and fundraising. This dual coding facilitates preparation of the statement of activities and statement of functional expenses. The primary categories include the following:

Assets. Includes cash and cash equivalents, receivables, prepaid expenses, investments, and property and equipment. Assets may be tracked by fund or restriction category.

Liabilities. Includes accounts payable, accrued expenses, deferred revenue, refundable advances, and debt obligations.

Net assets. Total assets minus total liabilities, stated with donor restrictions and without donor restrictions.

Revenue and support. Includes contributions, grants, program service revenue, membership dues, special events, and investment income.

Expenses. Includes program services, management and general, and fundraising, further detailed by natural expense classifications.

Nonprofit Budgeting

A nonprofit budget is a formal financial plan that translates mission objectives into projected revenues and expenditures for a fiscal period. Unlike a purely profit-driven entity, a nonprofit’s budget must align resource allocation with programmatic outcomes, donor restrictions, grant compliance requirements, and liquidity constraints. It is typically prepared on an accrual basis and may incorporate fund-level detail to ensure that restricted and unrestricted resources are properly planned and monitored. The budget functions as both a planning instrument and a control mechanism, guiding management decisions throughout the year. The key reasons a nonprofit uses a budget include the following:

Mission alignment. Ensures that financial resources are directed toward approved programs and strategic priorities.

Financial control. Establishes spending limits and supports variance analysis.

Grant and donor compliance. Demonstrates the responsible stewardship of restricted funds.

Cash flow management. Highlights timing differences between receipts and expenditures.

Board oversight. Provides a framework for governance review and performance monitoring.

Nonprofit Financial Statements

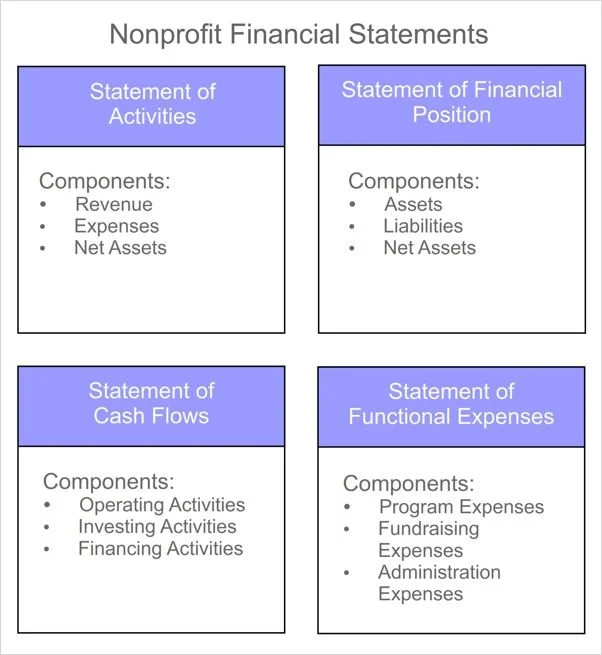

Nonprofit entities present four core financial statements under U.S. GAAP. While they parallel the statements issued by for-profit organizations, the terminology and presentation reflect the absence of ownership interests and the presence of donor-imposed restrictions. The objective is to communicate liquidity, operating performance, and stewardship over restricted and unrestricted resources. The statements are as follows:

Statement of financial position. This statement is the nonprofit equivalent of a balance sheet. It reports assets, liabilities, and net assets as of a specific date. Net assets are classified into two categories: net assets without donor restrictions and net assets with donor restrictions. The statement highlights liquidity, the composition of investments and receivables, and the extent of donor-imposed limitations on resources. It enables users to assess solvency and financial flexibility.

Statement of activities. This statement replaces the traditional income statement. It reports revenues, support, expenses, gains, and losses for the reporting period, along with changes in net asset classifications. Revenues are presented by restriction category, and expenses are typically shown by functional classification such as program services and supporting services. The statement explains how the organization’s net assets increased or decreased during the period.

Statement of cash flows. This statement reports cash inflows and outflows classified as operating, investing, and financing activities. It provides insight into cash liquidity, capital expenditures, and financing activities such as donor-restricted contributions for long-term purposes.

Statement of functional expenses. Required for voluntary health and welfare organizations and commonly presented by other nonprofits, this statement disaggregates expenses by both natural classification, such as salaries, rent, and supplies, and functional classification, such as program, management and general, and fundraising. It enhances transparency by showing how resources are allocated between mission-related activities and administrative support.

The contents of these statements are summarized in the following graphic:

Together, these four statements provide a comprehensive view of financial condition, operating performance, cash management, and stewardship of donor resources. The following exhibit compares the financial statements generated by a nonprofit and for-profit entity.

Nonprofit Tax Forms

Although most nonprofit organizations are exempt from federal income tax under Internal Revenue Code Section 501(c), they remain subject to a range of federal and state filing requirements. Tax compliance is therefore procedural rather than profit-based. The exact forms required depend on the organization’s size, activities, payroll structure, and revenue sources. Any failure to file required forms can result in penalties or the automatic revocation of tax-exempt status. The primary federal filings include the following:

Form 990. The annual information return for tax-exempt organizations. Larger nonprofits file Form 990; smaller organizations may file Form 990-EZ, while very small organizations file Form 990-N (e-Postcard). It reports governance, compensation, program accomplishments, and financial data.

Form 990-T. Filed when a nonprofit earns unrelated business taxable income. Income from activities not substantially related to the exempt purpose may be subject to corporate income tax.

Form 1023. The application used to obtain recognition of exemption under Section 501(c)(3). Smaller organizations may use Form 1023-EZ.

Form 941. Filed quarterly to report payroll taxes withheld and employer payroll tax liabilities.

Form W-2 and Form 1099-NEC. Used to report compensation paid to employees and independent contractors.

Form 990-PF. Required for private foundations, with additional reporting on minimum distribution requirements and excise taxes.

In addition, state filings may include charitable solicitation registrations, state income or franchise tax returns, and sales tax exemption documentation.

Nonprofit Accounting Key Concepts

Nonprofit accounting employs a number of concepts that differ from the accounting by a for-profit entity. These concepts encompass programs, management and administration, fundraising activities, budgeting, net assets, and a different set of financial statements. We address these topics below.

Nonprofit Programs

The reason why a nonprofit exists is to provide some kind of service, which is called a program. Examples of programs are providing meals to the elderly, offering free training classes, and distributing printed materials about safety hazards. Whatever the program may be, the accounting system should be designed to accumulate information about program revenues and expenses, so that management can determine how resources are being allocated to fulfill a nonprofit’s mission. It is particularly important to separate revenues and expenses for programs from the other activities of a nonprofit, especially the fundraising area and the management and administration area. When a sophisticated donor wants to see how well a nonprofit is managing its resources, it will likely want to see a breakdown of results that separates each individual program, and which separately shows fundraising expenses and management and administration expenses. Doing so reveals the relative proportions of resources being spent on the core mission of the entity.

Nonprofit Fundraising Activities

Fundraising is the sales and marketing component of a nonprofit, tasked with raising funds via a variety of methods to support the expenditure level of the organization. The activities of this group may include any of the following:

Grant proposals

Direct solicitation of individuals and businesses for contributions

E-mail solicitations through a mailing list of donors

Passive solicitation via a nonprofit’s website

Seminars regarding estate planning

Fundraising events, such as charity balls and art auctions

Contacting employers regarding matching contributions

A key component of fundraising is its associated marketing activities. Nonprofit marketing involves creating an image of the entity that makes it an attractive target for donors. Marketing can involve advertising, printed materials, hands-on contact with donors, interviews on the radio or television, local presentations, the creation of an attractive website, and so forth.

A key accounting consideration in the fundraising area is to track fundraising expenses at the level of the individual fundraising activity. By doing so, you can determine whether the amount of funds generated exceeds the associated fundraising cost. Without this level of detail, it is quite likely that the development director will continue to spend time and money on fundraising activities that do not generate an adequate return.

Nonprofit Management and Administration

Those activities not directly related to fundraising or programs are considered to fall within the management and administration classification. This classification provides operational support to the entire organization, and ensures that other activities run as smoothly as possible. The main activity areas provided by it include:

Accounting and finance services

Facility maintenance

Human resources services

Information technology maintenance

Risk management and legal services

Strategic planning and budgeting

The proportion of expenditures assigned to this classification is of deep concern to donors, who do not want to see their contributions “squandered” on areas outside of the core programs offered by a nonprofit. For this reason, the executive directors of nonprofits pay considerable attention to paring back management and administration expenses.

Nonprofit Net Assets

A net asset is the equivalent of retained earnings in the financial statements of a for-profit business. When contributing assets, a donor may impose restrictions on their use. The result is two types of net assets, which are classified as net assets with donor restrictions and net assets without donor restrictions. The accounting for these types of net assets varies, as noted below:

Net assets without donor restrictions. When a donor imposes no restriction on a contribution made to a nonprofit, the nonprofit records the contribution as an asset and as contribution revenue with no donor restrictions. These funds are used to pay for the general operations of a nonprofit. The fundraising staff strongly encourages donors to make unrestricted donations, since these funds can be put to the broadest possible range of uses. Since this contribution revenue also creates a profit, the profit appears in the statement of financial position as an increase in net assets without donor restrictions.

Net assets with donor restrictions. When a donor imposes a restriction on a contribution made to a nonprofit, the nonprofit records the contribution as contribution revenue with donor restrictions. Only the donor can change this designation; a nonprofit’s board of directors is not allowed to do so.

The totals of each of these classifications are reported within the net assets section of the statement of financial position, along with a grand total for all net assets.

A final thought regarding net assets is that they do not refer to assets. An asset is an item of economic value that is expected to yield a benefit in future periods. A net asset is more like a separate project, for which a separate set of financial statements can be generated.

FAQs

How does nonprofit accounting differ from for-profit accounting?

Nonprofit accounting differs from for-profit accounting in that its primary objective is stewardship and mission fulfillment rather than profit maximization, so financial reporting emphasizes accountability to donors, grantors, and regulators. Nonprofits use fund accounting and classify net assets as with or without donor restrictions, whereas for-profit entities focus on equity accounts and retained earnings. In addition, nonprofits report expenses by both natural and functional classifications and prepare a statement of activities instead of an income statement that is centered on net income.

What kind of accounting do nonprofits use?

Nonprofits use fund accounting, which is a system designed to track resources by purpose and restriction rather than by profit center. They typically maintain their books on the accrual basis of accounting in accordance with U.S. GAAP, particularly FASB guidance applicable to not-for-profit entities. This structure allows them to segregate net assets with and without donor restrictions while producing financial statements such as the statement of financial position and statement of activities.

How does a nonprofit set up a fund accounting system?

A nonprofit sets up a fund accounting system by first identifying the types of funds required, such as unrestricted operating funds, temporarily restricted program funds, and permanently restricted endowments, based on donor intent and board designations. It then designs a chart of accounts that assigns unique fund codes to revenues, expenses, assets, and liabilities so that transactions can be segregated and reported by restriction and program. Finally, it configures its accounting software to track both natural and functional expense classifications, ensuring compliance with GAAP reporting and facilitating the preparation of the statement of activities and related disclosures.