Commission expense accounting

/What is a Commission?

A commission is a fee that a business pays to a salesperson in exchange for his or her services in either facilitating, supervising, or completing a sale. The commission may be based on a flat fee arrangement, or (more commonly) as a percentage of the revenue generated. Less-common commission structures are based on the gross margin or net income generated by a sale; these structures are typically less used, since they are more difficult to calculate. A commission may be earned by an employee or an outside salesperson or entity.

Accounting for a Commission

Under the accrual basis of accounting, you should record an expense and an offsetting liability for a commission in the same period as you record the sale generated by the salesperson, and when you can calculate the amount of the commission. This is a debit to the commission expense account and a credit to a commission liability account (which is usually classified as a short-term liability, except for cases where you expect to pay the commission in more than one year).

Under the cash basis of accounting, you should record a commission when it is paid, so there is a credit to the cash account and a debit to the commission expense account.

If an employee is receiving a commission, then the company withholds income taxes on the amount of the commission paid to the employee. If the person receiving the commission is not an employee, then that person considers the commission to be revenue, and may pay taxes if there is a resulting profit.

Related AccountingTools Courses

Presentation of Commission Expense

You can classify the commission expense as part of the cost of goods sold, since it directly relates to the sale of goods or services. It is also acceptable to classify it as part of the expenses of the sales department.

Example of the Accounting for Commissions

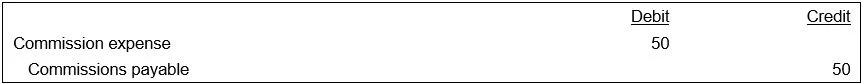

Fred Smith sells a $1,000 widget for ABC International. Under the terms of his commission agreement, he receives a 5% commission on the revenue generated by the transaction, and will be paid on the 15th day of the following month. At the end of the accounting period in which Mr. Smith generates the sale, ABC creates the following entry to record its liability for the commission:

ABC then reverses the entry at the beginning of the following accounting period, because it is going to record the actual payment on the 15th of the month. Thus, the reversing entry is:

On the 15th of the month, ABC pays Mr. Smith his commission and records this entry: