Accrued payroll definition

/What is Accrued Payroll?

Accrued payroll is all forms of compensation owed to employees that have not yet been paid to them. It represents a liability for the employer. The accrued payroll concept is only used under the accrual basis of accounting; it is not used under the cash basis of accounting. The key components of accrued payroll are salaries, wages, commissions, bonuses, and payroll taxes.

How to Calculate Accrued Payroll

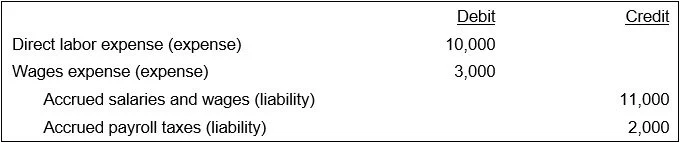

The amount of accrued payroll to record at the end of an accounting period is usually comprised of the compensation owed to hourly employees for the period from the last day paid through the end of the period, plus any payroll taxes related to those unpaid wages. Depending on the length of the payroll cycle, it is less common to have any accrued payroll for salaried employees, since they are frequently paid through the end of the accounting period. The following exhibit shows a sample entry that breaks out the accrual for direct labor (part of the cost of goods sold), while all other wages earned are listed in the wages expense line item.

Example of Accrued Payroll

A company’s employees work from March 25 to March 31, but their next payday is on April 5. As of March 31, the company owes employees wages for the last week of March, even though they will not be paid until April. If the total wages earned by employees during this period amount to $20,000, the company records an accrued payroll liability of $20,000 on its balance sheet as of March 31. When the company processes payroll on April 5, it reduces this liability and records the payment as an expense. This ensures that the company’s financial statements reflect all employee compensation owed, even if it has not yet been paid.

FAQs

How does accrued payroll differ from payroll payable?

Accrued payroll represents estimated compensation earned by employees but not yet processed through the payroll system at period end. Payroll payable reflects wages that have been formally calculated, recorded, and are awaiting payment. The key difference is that accrued payroll is based on estimation and cutoff timing, while payroll payable is based on finalized payroll amounts.