Other comprehensive income definition

/Definition of Other Comprehensive Income

Other comprehensive income contains all changes that are not permitted to be included in profit or loss. It is particularly valuable for understanding ongoing changes in the fair value of a company's assets. If an item listed in other comprehensive income becomes a realized gain or loss, you then shift it out of other comprehensive income and into net income or net loss. This can happen, for example, when you sell an investment security for which you already recorded an unrealized gain in other comprehensive income. At the point of sale, this is now a realized gain, which shifts into net income. A company can display this reclassification adjustment either on the face of the financial statements, or in the accompanying notes.

What to Include in Other Comprehensive Income

Items that can be inserted into other comprehensive income include the following:

Available-for-sale securities fair value changes that were previously written down as impaired

Available-for-sale securities unrealized gains and losses

Cash flow hedge derivative instrument gains and losses

Debt security unrealized gains and losses arising from a transfer from the available-for-sale category to the held-to-maturity category

Foreign currency gains and losses on intra-entity currency transactions where settlement is not planned or anticipated in the foreseeable future

Foreign currency transaction gains and losses that are hedges of an investment in a foreign entity

Foreign currency translation adjustments

Pension or post-retirement benefit plan gains or losses

Pension or post-retirement benefit plan prior service costs or credits

Pension or post-retirement benefit plan transition assets or obligations that are not recognized as a component of the net periodic benefit or cost

It is acceptable to either report components of other comprehensive income net of related tax effects, or before related tax effects with a single aggregate income tax expense or benefit shown that relates to all of the other comprehensive income items.

The items to be included in this classification may be only rarely encountered by a smaller business, so this type of organization may only occasionally report other comprehensive income.

Related AccountingTools Courses

Example of Other Comprehensive Income

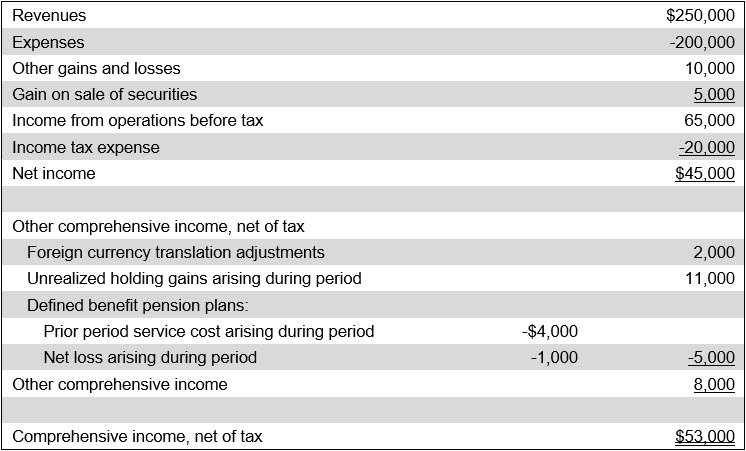

An example of a possible format for reporting other comprehensive income in the income statement is:

Guttering Candle Company

Statement of Income and Comprehensive Income

For the Year Ended December 31, 20X1

If comprehensive income is stated in two separate statements, they shall be presented consecutively. The presentation of other comprehensive income shall encompass the following:

Begin with net income (optional)

State the components of and total for other comprehensive income

State the total for comprehensive income

An example of the separate statement of comprehensive income follows.

FAQs

How Does Other Comprehensive Income Affect Shareholders’ Equity?

Other comprehensive income affects shareholders’ equity through the accumulated other comprehensive income (AOCI) account, which captures unrealized gains and losses not yet included in net income. These changes adjust total equity without impacting retained earnings until the underlying items are realized. As a result, other comprehensive income provides a bridge between current performance and future potential impacts on owners’ equity.