How to start a petty cash fund

/What is Petty Cash?

Petty cash is a small amount of cash that is used to make incidental cash purchases and reimbursements, such as for delivered meals. Petty cash can mitigate the effects of the more cumbersome accounts payable process, which involves the issuance of a check.

Setting Up a Petty Cash Fund

There are several well-defined steps associated with setting up a petty cash fund, which are as follows:

Step 1. Create a Petty Cash Account

To start a petty cash fund, you need to create a petty cash account in the general ledger. This account is in addition to the firm’s other cash accounts, such as its checking account and savings account. The balances in all cash accounts are typically aggregated into a single line item in the balance sheet, which is then reported within the current assets section of the report.

Step 2. Deposit Cash into the Account

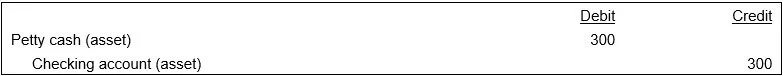

The second step is to deposit cash into the petty cash account, probably by writing a check to the account from the corporate checking account. A typical petty cash account balance is $300; such a payment would result in a debit for $300 to the petty cash account. A sample journal entry that shows this transaction appears next.

Step 3. Assign Responsibility for Petty Cash

The third step is to give someone responsibility to be the petty cash custodian. This person is responsible for making disbursements from the petty cash fund and for keeping track of all related receipts. At all times, the custodian must maintain a balance of cash and receipts that exactly matches the original funding for the petty cash account.

Step 4. Replenish Petty Cash

The final step is for the petty cash custodian to periodically replenish the petty cash fund. This is done by charging all receipts in the petty cash box to expense and receiving cash into the fund in the same amount. This step results in the periodic recognition of all expenditures from petty cash as expenses, while also keeping the amount of cash in the fund topped up.

FAQs

How are petty cash disbursements documented?

Petty cash disbursements are documented using receipts or petty cash vouchers that describe the amount, date, and purpose of each expense. Supporting documentation is retained by the petty cash custodian until the fund is replenished. These records provide the basis for reimbursement and reconciliation of the fund.