The discount method definition

/What is the Discount Method?

The discount method can refer to two possible applications, both involving lending activities. One application is to reduce the amount paid for a bond to increase the associated interest rate for the investor, while the other application involves the issuance of a reduced loan amount to offset the initial deduction of interest payable. In more detail, these two applications of the discount method are noted below.

The Discount Method for Bonds

The discount method for bonds allocates the difference between a bond’s face value and its lower issue price to interest expense over the bond’s life. This amortization increases the bond’s carrying value each period until it equals par at maturity. The allocation may be performed using the effective interest method or, if not materially different, the straight-line method.

A company issues a $1,000 face value bond with a 5-year maturity and a coupon rate of 4% per year, but the current market interest rate is 6%. Since the bond's coupon rate is lower than the market rate, investors will not be willing to pay the full face value. Instead, the bond will be sold at a discount to attract buyers. To determine the bond's price, we need to discount both the coupon payments and the face value back to the present using the market interest rate of 6%. The key information is as follows:

Annual coupon payment = 4% of $1,000 = $40

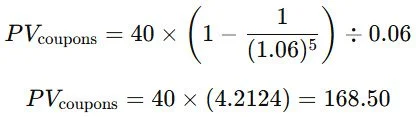

Present value of annuity (coupon payments):

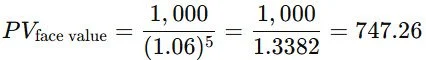

Present value of the bond’s face value:

Total bond price:

$168.50 + $747.26 = $915.76

Therefore, the bond sells for $915.76, which is below its $1,000 face value—hence, it is sold at a discount. If an investor were to hold the bond to maturity, they would receive the full face value of $1,000 along with the interest payments. Since they originally purchased the bond for $915.76, the effective yield (or yield to maturity, YTM) is higher than the coupon rate of 4%—closer to the market rate of 6%.

Related AccountingTools Courses

The Discount Method for Debt

The discount method refers to the issuance of a loan to a borrower, with the eventual amount of interest payable already deducted from the payment. For example, a borrower may agree to borrow $10,000 of funds under the discount method at a 5% interest rate for one year, which means that the lender pays only $9,500 to the borrower. The borrower is obligated to pay back the full $10,000 at the end of the year. This approach yields a higher effective interest rate to the lender, since the interest payment is calculated based on a higher amount than was paid to the lender. In the example, the effective interest rate was 5.3% (calculated as $500 interest, divided by $9,500 paid to the borrower).

The first interpretation of the term is the more common usage of the discount method.