Accumulated depreciation definition

/What is Accumulated Depreciation?

Accumulated depreciation is the total depreciation for a fixed asset that has been charged to expense since that asset was acquired and made available for use. The intent behind doing so is to approximately match the revenue or other benefits generated by the asset to its cost over its useful life (known as the matching principle).

The amount of accumulated depreciation for an asset will increase over time, as depreciation continues to be charged against the asset. The original cost of the asset is known as its gross cost, while the original cost of the asset less the amount of accumulated depreciation and any impairment charges is known as its net cost or carrying amount.

The accumulated depreciation account is an asset account with a credit balance (also known as a contra asset account). When the asset is eventually retired or sold, the amount in the accumulated depreciation account relating to that asset is reversed, as is the original cost of the asset, thereby eliminating all record of the asset from the company's balance sheet. If this derecognition were not completed, a company would gradually build up a large amount of gross fixed asset cost and accumulated depreciation on its balance sheet.

Related AccountingTools Courses

Impact of Accelerated Depreciation on Accumulated Depreciation

The balance in the accumulated depreciation account will increase more quickly if a business uses an accelerated depreciation methodology, since doing so charges more of an asset's cost to expense during its earlier years of usage. The use of accelerated depreciation makes it more difficult to judge how old a reporting entity’s fixed assets are, since the proportion of accumulated depreciation to fixed assets is higher than would normally be the case.

Presentation of Accumulated Depreciation

Accumulated depreciation appears on the balance sheet as a reduction from the gross amount of fixed assets reported. It is usually reported as a single line item, but a more detailed balance sheet might list several accumulated depreciation accounts, one for each fixed asset type. The latter form of presentation is more useful to an investor, since the proportion of accumulated depreciation to fixed assets provides an indicator of the age of the reporting entity’s fixed assets; for example, a high proportion of accumulated depreciation indicates that a firm’s fixed assets are old. A typical presentation of accumulated depreciation appears in the following exhibit, which shows the fixed assets section of a balance sheet.

How to Calculate Accumulated Depreciation

Calculating accumulated depreciation is a simple matter of running the depreciation calculation for a fixed asset from its acquisition date to the current date. However, it is useful to spot-check the calculation of the depreciation amounts that were recorded in the general ledger over the life of the asset, to ensure that the same calculations were used to record the underlying depreciation transaction. For example, if an impairment charge was made against an asset, this reduces the carrying amount of the asset and may alter its remaining useful life; both changes would be reflected in the depreciation calculation, altering the amount charged to expense each month.

Example of Accumulated Depreciation

ABC International buys a machine for $100,000, which it records in the Machinery fixed asset account. ABC estimates that the machine has a useful life of 10 years and will have no salvage value, so it charges $10,000 to depreciation expense per year for 10 years. The annual entry, showing the credit to the accumulated depreciation account, is:

| Debit | Credit | |

| Depreciation expense | 10,000 | |

| Accumulated depreciation | 10,000 |

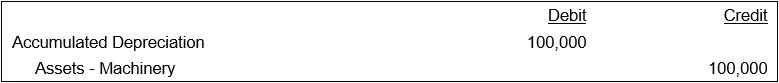

After 10 years, ABC retires the machine, and records the following entry to purge both the asset and its associated accumulated depreciation from its accounting records:

Accumulated Depreciation and Net Book Value

Accumulated depreciation is incorporated into the calculation of an asset's net book value. To calculate net book value, subtract the accumulated depreciation and any impairment charges from the initial purchase price of an asset. The residual balance is the net book value of the asset. For example, an asset is acquired for $1,000,000. After three years, the company records an asset impairment charge of $200,000 against the asset. At that point, the accumulated depreciation for the asset is $300,000. This means that the asset’s net book value is $500,000 (calculated as $1,000,000 purchase price - $200,000 impairment charge - $300,000 accumulated depreciation).

Accumulated Depreciation vs. Depreciation Expense

Depreciation expense is a portion of the capitalized cost of an organization’s fixed assets that are charged to expense in a reporting period. It is recorded with a debit to the depreciation expense account and a credit to the accumulated depreciation contra asset account. One difference between the two concepts is that accumulated depreciation is stated on the balance sheet (as a subtraction from fixed assets), while depreciation expense appears on the income statement, usually within the operating expenses section. Another difference is that the depreciation expense for an asset is halted when the asset is sold, while accumulated depreciation is reversed when the asset is sold.

Is Accumulated Depreciation an Asset?

Accumulated depreciation is the total amount of deprecation that has been charged to-date against an asset. It is stored in the accumulated depreciation account, which is classified as a contra asset. This account is paired with and offsets the fixed assets line item in the balance sheet, and so reduces the reported amount of fixed assets. This account has a natural credit balance, rather than the natural debit balance of most other asset accounts. Despite these factors, the accumulated depreciation account is reported within the assets section of the balance sheet.