Traceable costs definition

/What are Traceable Costs?

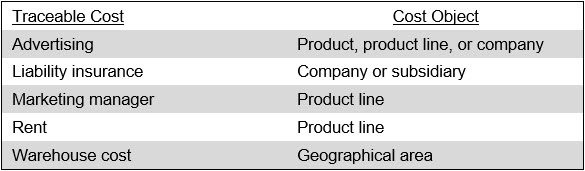

A traceable cost is a cost for which there is a direct, cause-and-effect relationship with a process, product, customer, geographical area, or other cost object. If the cost object goes away, then the traceable cost associated with it should also disappear. A traceable cost is important, because it is an expense that you can reliably assign to a cost object when constructing an income statement showing the financial results of that cost object. It is also useful to understand when cutting back on expenses, so that you can focus on eliminating certain cost objects, for which the related expenses will also be eliminated. Thus, a traceable cost is an expense management tool. Examples of traceable costs are:

For example, a company is planning to eliminate an entire product line, and wants to understand which expenses will be terminated when the product line is shut down. The costs traceable to the product line include advertising expenses, a marketing specialist, a production line, and a warehouse. All of these costs will be eliminated.

A traceable cost may only be associated with an intermediate level of cost object, and not drill down all the way to the most detailed level. For example, a company may incur the cost of building insurance for its production facility. This cost is only traceable to the building, in that the cost would disappear if the building were to be sold. The cost cannot be traced to the cost objects within the building, such as a production line, since the line could be shuttered but the insurance expense would still be incurred as long as the building was owned by the company.

Related AccountingTools Course

Example of a Traceable Cost

An example of a traceable cost is the salary of a store manager for a specific retail location. Suppose a clothing company operates several retail stores, and each store has its own manager responsible for overseeing daily operations, staff, and customer service. The salary paid to the manager of Store A is a traceable cost directly linked to that specific store because it exists solely due to the operation of Store A. If the company decides to close Store A, the store manager's position would be eliminated, and the associated salary cost would no longer be incurred. This is different from a general administrative salary, like that of a regional manager, which might continue even if Store A closes because it serves multiple stores. In this case, the store manager's salary is a clear example of a traceable cost, as it is directly and exclusively connected to the operations of Store A and would disappear if the store ceased to operate.