General ledger overview

/What is a General Ledger?

A general ledger is the master set of accounts that summarize all transactions occurring within an entity. The information in a general ledger is summarized into a reporting entity’s financial statements. The financial statements include an income statement, balance sheet, and statement of cash flows.

What is Included in a General Ledger?

The general ledger contains all of the accounts currently being used in a chart of accounts, and is sorted by account number. Either individual transactions or summary-level postings from subsidiary-level ledgers are listed within each account number, sorted by transaction date.

Each entry in the general ledger includes a reference number that states the source of the information. The source may be a subsidiary ledger, such as the sales journal or cash disbursements journal, or it may be a journal entry. In some systems, the initials of the employee who created each entry is also included.

How to Search for Information in a General Ledger

It is extremely easy to locate information pertinent to an accounting inquiry in the general ledger, which makes it the primary source of accounting information. For example:

A manager reviews the balance sheet and notices that the amount of debt appears to be too high. The accounting staff looks up the debt account in the general ledger and sees that a loan was added at the end of the month.

A manager reviews the income statement and sees that the bad debt expense for his division is very high. The accounting staff looks up the expense in the general ledger, drills down to the source journal entry, and sees that a new bad debt projection system was the cause of the increase in bad debt expense.

As the examples show, the source of an inquiry is frequently the financial statements; when conducting an investigation, the accounting staff begins with the general ledger, and may drill down to source documents from there to ascertain the reason(s) for an issue.

Related AccountingTools Courses

Example of a General Ledger

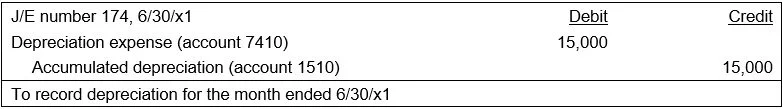

An entry in the general ledger may come from a variety of sources and in different formats, but the most basic transaction source is the journal entry, which is created in a simple debit and credit format. For example, if you were to create a journal entry to record depreciation, it might look like this:

The information would then appear in the general ledger in two places, in the accumulated depreciation account and the depreciation expense account. For example, the entry would appear in the accumulated depreciation account in the general ledger in a format similar to the following:

There may also be a "balance" column on the far right side of the general ledger, which lists a running total of the balance in each account.

This is only a sample general ledger format; there are many variations on the layout presented here.

Related Articles

How to Post to the General Ledger

How to Reconcile the General Ledger

The Difference Between the General Ledger and General Journal