Basic earnings per share formula

/What is the Basic Earnings per Share Formula?

Basic earnings per share is the amount of a company’s earnings allocable to each share of its common stock. It is a useful measure of performance for companies with simplified capital structures that only contain common stock. If a business only has common stock in its capital structure, the company presents only its basic earnings per share for income from continuing operations and net income. If there are situations under which more shares might be issued, such as when stock options are outstanding, then diluted earnings per share must also be reported. As the name implies, diluted earnings per share present the lowest possible earnings per share, based on assumptions that all possible shares are issued.

Presentation of Basic Earnings per Share

Basic earnings per share information is reported on the income statement of a publicly-held company. The reporting of basic earnings per share is not required for privately-held entities. A sample presentation appears in the following extract from an income statement.

How to Calculate Basic Earnings Per Share

The formula for basic earnings per share is:

Profit or loss attributable to common equity holders of the parent business ÷

Weighted average number of common shares outstanding during the period

In addition, this calculation should be subdivided into:

The profit or loss from continuing operations attributable to the parent company

The total profit or loss attributable to the parent company

Related AccountingTools Course

When calculating basic earnings per share, incorporate into the numerator an adjustment for dividends. You should deduct from the profit or loss the after-tax amount of any dividends declared on non-cumulative preferred stock, as well as the after-tax amount of any preferred stock dividends, even if the dividends are not declared; this does not include any dividends paid or declared during the current period that relate to previous periods.

Also, you should incorporate the following adjustments into the denominator of the basic earnings per share calculation:

Contingent stock. If there is contingently issuable stock, treat it as though it were outstanding as of the date when there are no circumstances under which the shares would not be issued.

Weighted-average shares. Use the weighted-average number of shares during the period in the denominator. You do this by adjusting the number of shares outstanding at the beginning of the reporting period for common shares repurchased or issued in the period. This adjustment is based on the proportion of the days in the reporting period that the shares are outstanding.

Example of Basic Earnings per Share

Lowry Locomotion earns a profit of $1,000,000 net of taxes in Year 1. In addition, Lowry owes $200,000 in dividends to the holders of its cumulative preferred stock. Lowry calculates the numerator of its basic earnings per share as follows:

$1,000,000 Profit - $200,000 Dividends = $800,000

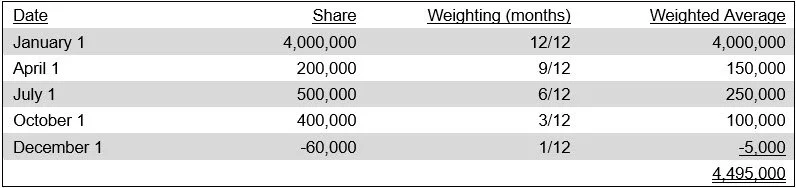

Lowry had 4,000,000 common shares outstanding at the beginning of Year 1. In addition, it sold 200,000 shares on April 1 and 400,000 shares on October 1. It also issued 500,000 shares on July 1 to the owners of a newly-acquired subsidiary. Finally, it bought back 60,000 shares on December 1. Lowry calculates the weighted-average number of common shares outstanding as follows:

Lowry’s basic earnings per share is:

$800,000 adjusted profits ÷ 4,495,000 weighted-average shares = $0.18 per share