Bonus accrual definition

/What is a Bonus Accrual?

A bonus accrual is the recognition of a bonus compensation expense whenever there is an expectation that the financial or operational performance of a company at least equals the performance levels required in any active bonus plans. Bonus accruals can represent a substantial expense when bonuses form a large part of the compensation structure of a business, so the decision to record a bonus accrual is not a minor one.

Accounting for a Bonus Accrual

The decision to accrue a bonus calls for considerable judgment, for the entire period of performance may encompass many future months, during which time a person may not continue to achieve his bonus plan objectives, in which case any prior bonus accrual should be reversed. Here are some alternative ways to treat a bonus accrual during the earlier stages of a bonus period:

Accrue no expense at all until there is a reasonable probability that the bonus will be achieved.

Accrue a smaller expense early in a performance period to reflect the higher risk of performance failure, and accrue a larger expense later if the probability of success improves.

One thing you should not do is accrue a significant bonus expense in a situation where the probability that the bonus will be awarded is low; such an accrual is essentially earnings management, since it creates a false expense that is later reversed when the performance period is complete.

Related AccountingTools Courses

Example of a Bonus Accrual

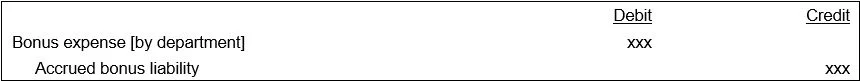

A sample bonus accrual is noted below.

The preceding example shows a simple accrual of just the bonus expense. An alternative is to also accrue all related payroll taxes; doing so increases the accuracy of the accrual, but is also more complex to calculate.

When an accrued bonus is later paid, the resulting journal entry eliminates the accrued bonus liability, while also recognizing any payroll tax liabilities associated with the bonus. A sample template for this entry is:

The Two and a Half Month Rule

If a company accrues a bonus expense at the end of one tax year and does not pay out the bonus within two and a half months of the year end, these payments are not tax deductible unless the employee receiving the bonus has reported the bonus payment in his taxable income. Alternatively, if the company does pay the employee within two and a half months of the year end, it can deduct the expense in the tax year in which the employee earned the bonus.