Office supplies expense definition

/What is Office Supplies Expense?

Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. These items are charged to expense when used; or, if the cost of supplies is immaterial, it is charged to expense when the cost is initially incurred. There may be a separate office supplies expense account for each department in a business.

Examples of Office Supplies Expense

There are many types of office supplies that may be charged to expense, including the following:

Printer paper. Standard paper used for printing documents, reports, and correspondence in an office setting.

Ink cartridges. Replaceable components for printers that supply ink for producing printed materials.

Pens and pencils. Writing instruments used for taking notes, signing documents, and general communication tasks.

Staplers and staples. Tools used to bind multiple sheets of paper together for organization and filing.

Notepads. Small pads of paper used for jotting down notes, ideas, and meeting minutes.

Folders and binders. Organizational items used to group and store documents for easy access and filing.

Sticky notes. Small adhesive-backed notes used for quick reminders or annotations on documents.

Envelopes. Paper containers used to send letters and documents through internal or external mail.

Scissors. Hand-operated cutting tools used for trimming paper, packaging, and other light materials.

Tape and tape dispensers. Adhesive products used for sealing envelopes, repairing documents, or mounting papers.

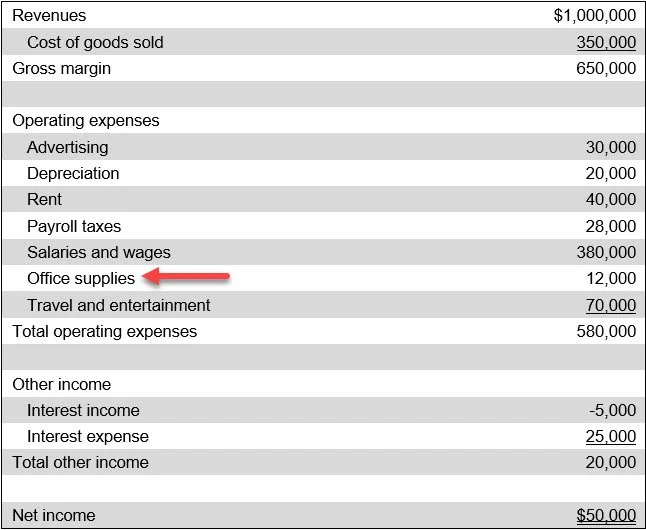

Presentation of Office Supplies Expense

Office supplies expense is usually classified within the operating expenses classification on an organization’s income statement. A sample presentation of this expense appears in the following exhibit.