Revaluation surplus definition

/What is a Revaluation Surplus?

A revaluation surplus is an equity account in which is stored any upward changes in the value of capital assets that exceed its prior book value. This surplus is only used when you are following the Revaluation Model to account for fixed assets. This approach is only allowed under International Financial Reporting Standards. No revaluation surplus is allowed for a firm that uses Generally Accepted Accounting Principles.

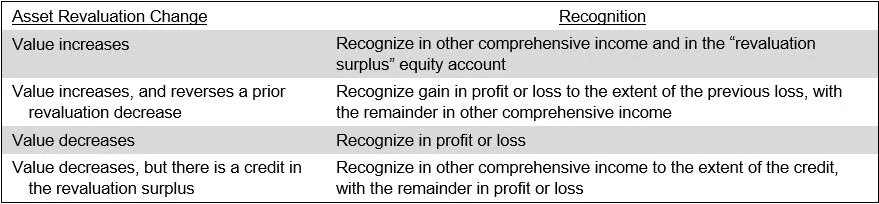

The rules regarding how to recognize changes in the revaluation of an asset are noted in the following exhibit.

Accounting for a Revaluation Surplus

When you revalue an asset upward, the incremental increase in the asset’s fair value over its prior carrying amount is a credit to the revaluation surplus account. Or, if there is a decrease in the asset’s value as part of the revaluation process, then the decrease is first offset against any prior revaluation surpluses - after that, any residual decrease in value is charged to expense. If a revalued asset is subsequently dispositioned out of a business, any remaining revaluation surplus is credited to the retained earnings account of the entity.

Related AccountingTools Courses

FAQs

Can a Revaluation Surplus be Distributed as Dividends?

A revaluation surplus cannot be distributed as dividends because it represents unrealized gains rather than actual profits. The surplus reflects an increase in asset value that has not been realized through sale or disposal. However, when the asset is eventually sold, the surplus may be transferred to retained earnings, making it available for distribution.